Venture debt providers

The ultimate guide to venture debt

Fund to ProfitabilityVenture debt can bridge a company to profitability. This is a great use of debt as it propels the company forward during a critical period of growth and can completely eliminate the need for a final round of equity financing. Debt financing for startups You can read more here about how to apply for venture debt financing from the EIB and the next steps of the process.

Capital venture debt

10 top venture debt firms

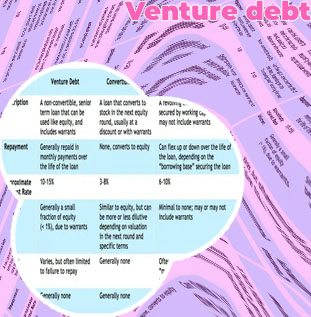

Most commercial banks do not offer venture debt. Instead, the majority of venture debt financing is provided by specialized banks or non-traditional lenders such as Silicon Valley Bank, Western Technology Investment, Trinity Capital and TriplePoint Capital. Other sources of venture debt include hedge funds, private equity firms and business development companies. Who Should Consider Venture Debt? Plus, because venture debt is generally available for growth-focused companies, lenders need to know that you’ll have the ability to meet repayment obligations. Being backed by venture capital helps assure them of this.