Dividend investing

Top 25 High Dividend Stocks

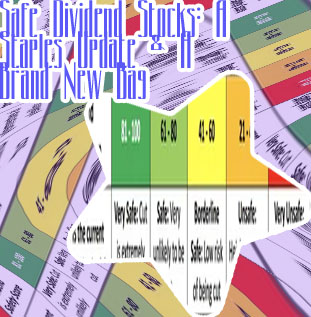

Then look at the stock’s payout ratio, which tells you how much of the company’s income is going toward dividends. A payout ratio that is too high — generally above 80%, though it can vary by industry — means the company is putting a large percentage of its income into paying dividends. In some cases dividend payout ratios can top 100%, meaning the company may be going into debt to pay out dividends. (Read our full guide on how to research stocks.) Safe dividend stocks As a financial planner, I’ve been in many meetings with prospective families who have different levels of investment education. I often find people think dividend investing is magic and must be the end-all, be-all of investing.

Stable dividend stocks

7 Problems with Dividend Investing

Dividend Traps: High-dividend yields may look attractive to the untrained eye, but companies with dividends that appear too good to be true can be a dangerous investment. While not always the case, businesses in distress may use incredibly high dividends to attract stock traders. It is entirely likely the dividend is still high after a stock price pullback, and the dividend hasn’t been cut, so be aware. Dividend Cover Broadcom (NASDAQ: AVGO) is a high-growth technology stock that also pays investors a juicy dividend. Broadcom has increased dividends annually by 39% in the last ten years. Its quarterly dividend per share has risen to $4.10 from $0.15 per share in July 2012. So, Broadcom offers investors a forward yield of 3.2%. Broadcom has also returned 1,830% in dividend-adjusted returns in the last decade.