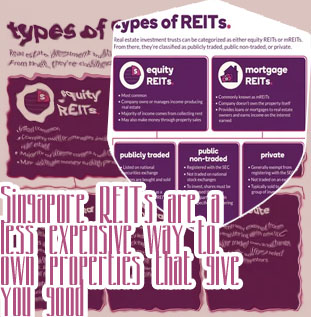

Invest in reits

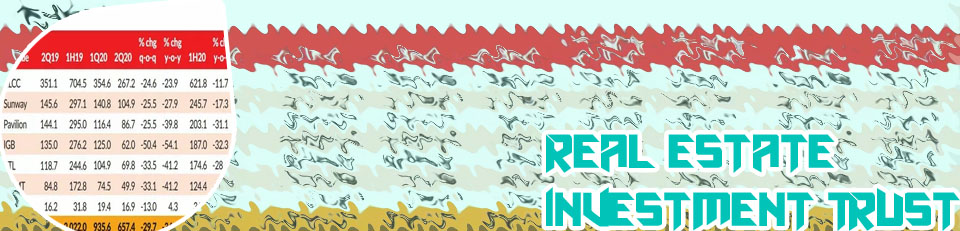

Stock Information

On September 22, American Tower Corporation (NYSE:AMT) hiked its quarterly dividend by 3% to $1.47 per share. This was the fourth consecutive quarterly dividend raise. Moreover, it has been raising its dividends consistently for the past 11 years, which makes it one of the best dividend stocks to buy now. As of October 24, the stock has a dividend yield of 3.13%. Reits to invest in REITs offer an alternative, though. This unique class of publicly traded company is granted special tax treatment to help it deal with the capital-intensive nature of the real estate business. And in exchange, all real estate investment trusts must deliver 90% of taxable income back to shareholders as terms of being structured as a trust instead of a typical stock. That means a mandate for big-time dividends.

Reit stock

Investing In REITs Vs Real Estate

INFLATION HEDGE: REITS HAVE HISTORICALLY PERFORMED WELL IN INFLATIONARY ENVIRONMENTS – Inflation is in the headlines and has become a discernable part of everyday life, with price increases evident at the gas station, grocery store and travel related industries, amongst others. Many businesses—and their stock prices—continue to suffer from increases in the cost of raw materials and wages, especially those businesses where it is difficult to pass on price increases to end consumers. REIT Valuation Metrics You Need to Know Discover our Capabilities