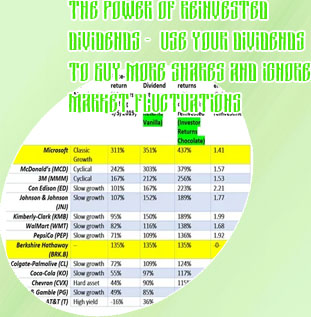

Dividend reinvestment plan

Overview of IBKR's Dividend Reinvestment Program (DRIP)

Shareholders can generally select whether they want full or partial participation in the plan. Full participation means that dividends payable on all shares you hold in the company (or fund) at each dividend record date will be subject to the plan. Drip stocks list Alternatively, details are available on request from Equiniti or Link (see registrars for contact details).

A dividend reinvestment plan

The DRIP will provide Definity's eligible shareholders with the opportunity to have all or a portion of the cash dividends declared on their common shares automatically reinvested into additional common shares on an ongoing basis until DRIP participation has been modified or terminated (the “Reinvestment Shares”) of the Company. The benefits of enrolling in the DRIP include the: Stanley Black & Decker This consumer staples stock is the maker of popular cereal brands and convenience foods households consume worldwide. Founded in 1906, the company has grown its distribution to over 180 countries, with manufacturing plants in 21 countries. Its cereal brand portfolio includes Apple Jacks, Corn Flakes, Corn Pops, Froot Loops, Frosted Flakes, Raisin Bran, Rice Crispies, and Special K. Its snacks include household brands Pop-Tarts, Pringles, CHEEZ-IT, Club and Town House crackers.

How does the reinvestment program work?

Click for Español How Does a Dividend Reinvestment Plan Work? Suspension of Dividend Reinvestment Plan

Stake dividend reinvestment plan

The Individual Investor's Guide to Dividend Reinvestment Plans. From the American Association of Individual Investors. Disadvantages of dividend reinvestment plans Your browser doesn't support HTML5 audio